The Kiyo Bank, Ltd. Using DataSpider Servista

Advancing the Data Utilization Necessary for Achieving a Bank’s Goal of Creating “Proposals to Reach Customers”

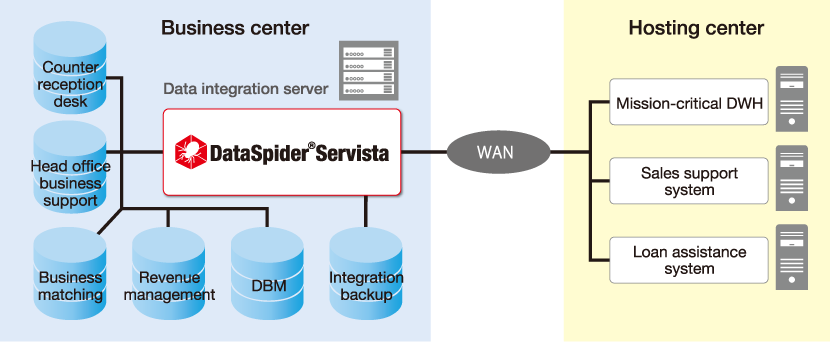

The Kiyo Bank, Ltd. (hereinafter “Kiyo Bank”), which has their headquarters in Wakayama Prefecture, renewed their infrastructure for the purpose of data utilization. To coincide with this renewal, the bank also began to create a mechanism for flexibly integrating their systems. As part of this mechanism, the bank used DataSpider Servista (hereinafter “DataSpider”) as middleware to enable data integration with no programming required. By using DataSpider, they were able to flexibly integrate systems such as core systems, sales support systems, and databases for business matching. This allowed them to create a platform capable of responding quickly to changes in the business environment.

USER PROFILE

Kiyo Bank was established as The Kiyo Savings Bank, Ltd. in 1895, and currently contributes to the vitalization of the regional economy as the only regional bank with its headquarters located in Wakayama Prefecture. Based their vision of becoming a “bank going beyond banks,” Kiyo Bank is currently in the progress of carrying out their fifth medium-term management plan, for which their basic policy is building a foundation to both enhance their presence in the regional community and to strengthen their earnings power.” The bank is actively expanding into neighboring Osaka Prefecture, and is working on various measures to achieve a sustainable business model that allows them to grow together with the regional community, while also shifting their focus from quantity to quality by utilizing data related to their sales activities.

Mr. Hiroyuki Sandou

General Manager of the Business Systems Department

The Kiyo Bank, Ltd.

Mr. Takeshi Miyamae

Deputy Manager of Systems in the Business Systems Department

The Kiyo Bank, Ltd.

Mr. Kazuyuki Do

Systems Group Leader in the Business Systems Department

The Kiyo Bank, Ltd.

Mr. Hiroto Hashizaki

Business Systems Department

The Kiyo Bank, Ltd.

Background: Reforming the Data Utilization Platform, Which Will Become Even More Necessary for the Bank in the Future

Kiyo Bank was established as The Kiyo Savings Bank, Ltd. in 1895, and now contributes to the vitalization of the regional economy as the only regional bank with their headquarters located in Wakayama Prefecture. Based on its vision of becoming a “bank going beyond banks,” Kiyo Bank is currently in the progress of carrying out their fifth medium-term management plan, for which their basic policy is building a foundation to both enhance their presence in the regional community and to strengthen their earnings power. As such, the bank is making a variety of efforts to implement a sustainable business model that will allow them to grow together with the regional community.

At this bank, a platform for data utilization was constructed. This platform allows data to be collected from the systems that are scattered throughout the bank, and to be utilized in order to provide services to customers. According to Mr. Hiroyuki Sandou, general manager of the Business Systems Department, “The effective utilization of the diverse data that exists within the bank is crucial for making proposals that get to the heart of our customers’ problems. However, because data collection tasks were formerly carried out manually, we could not keep up with sudden changes in the business environment.” The bank needed to optimize their processes for the purpose of data utilization, in order to create an environment with high cost performance, where investment capability could be generated.

With high reliability and flexibility

Development speed improved

With improved productivity

Extra time was created

By promoting in-house development

Development cost reduced

Introduction: Evaluating a Flexible Mechanism Provided by the Trustworthy Company That Developed HULFT

As the bank began examining solutions to help them optimize their processes, the idea of a data collection process suitable for data utilization caught the attention of Mr. Takeshi Miyamae, deputy manager of systems in the Business Systems Department. He says, “Previously, we had collected data by using different methods for each system. For example, we might use FTP for one system, or directly reference the databases for another. However, we needed to introduce a new mechanism that would allow us to use data in a set format, in a standardized way, as well as a mechanism that would allow us to improve our operational efficiency while also ensuring quality.” At this point, DataSpider caught Mr. Miyamae’s eye. “I was aware,” he says, “of the high reliability of HULFT, which we use in many places in our core systems. I can definitely say that I felt a sense of security, because DataSpider is made by the same company.”

At first, there was no target mechanism related to data integration, but then Mr. Hiroto Hashizaki, also a systems group member in the Business Systems Department, had the opportunity to become involved in the verification work. Once the settings for migrating data from the test database to another location were complete, Mr. Hashizaki says, “We were able to perform data integration in only ten minutes. I was honestly surprised that we were able to do it so easily.” Mr. Hashizaki had the opportunity, together with Mr. Kazuyuki Do, the systems group leader in the Business Systems Department, to attend a seminar and learn how to use DataSpider. The other staff members, however, were able to perform data integration by only reading the Help and performing simple operations in the GUI. For this reason, Mr. Hashizaki had high praise for DataSpider’s user friendliness.

Result: Expanding the Application of the Integration Platform as a Platform for Connecting Systems

Currently, even as the bank proceeds with the originally planned renewal of the data utilization platform, DataSpider is being flexibly utilized in situations where data integration is needed. Specifically, DataSpider is being used for a variety of applications, such as performing business matching among customers by using data from the sales support system, and data integration for the database management system that serves as the data utilization platform.

Mr. Do says, “It became necessary to develop data integration in order to set up a certain system. The quote we received from an external vendor was for about several 4 million yen, so we decided to change our policy and to use DataSpider to build the necessary functions. By using DataSpider, it is possible to set up data integration to meet the same requirements. This allows us to set up data integration within the bank, with minimal burden. The ability to reduce costs related to data integration, both now and in the future, was an important result.”

Another application that is easy to understand is the integration of tablet devices, which the bank is planning to introduce at its branches in order to improve the efficiency of teller window operations, with the core systems. According to Mr. Do, “We are considering using these tablets for two-way integration. Not only will we be able to use the tablets to enter customer information into the core systems, but we will also be able to bring up information that is registered in the core systems, such as the customer’s address and postal code, on the tablets.” Although they have not been released yet, the bank has also set up mechanisms to distribute Excel data containing information about business partners and data for all sales offices to each individual branch, or to collect and aggregate those results from each sales office.

With the introduction of DataSpider, the bank has actually been able to eliminate the one to two labor months that were previously required to extract data from one system. This reduction in labor hours means that the bank can now use that time for other business operations. According to Mr. Sandou, “If we had decided to develop the mechanism for integrating business matching and sales support from scratch, I don’t think we would even have completed testing yet. It is thanks to DataSpider that we are able to attempt all of these new measures.”

Regarding the support system, which is still in the process of verification, Mr. Do had the following praise: “I am grateful for their kind explanations of the things we didn't understand. DataSpider itself is not only a mechanism for data integration. It can also be used to send emails, to perform processing similar to RPA, and to do many other things. I am looking forward to receiving further support in the future.” Although Mr. Miyamae was skeptical at first, he now praises DataSpider for both its high reliability and its flexibility. “Once we actually tried using it,” he says, “we were able to perform development extremely quickly. Even when a sudden need arises for specific data, we can extract the data quickly by using Data Spider. That’s something we didn’t think was possible before. We are also surprised at how flexible it is.”

Mr. Sandou says that, in the future, he wants to seriously examine how to move forward with the use of internal and external APIs, by considering both DataSpider and the integration with APIs that must be made open to external parties. In conclusion, Mr. Do says that, as the bank continues improving their operational efficiency through the integration of various mechanisms, including cloud-based mechanisms, “Whenever we consider a new mechanism, I think it will be a prerequisite that the mechanism be able to connect with DataSpider. By setting prerequisites such as these, I’d like our stance going forward to be ‘DataSpider first.’”

Learn More About DataSpider Servista

Notes:

- HULFT and other products related to HULFT are registered trademarks or trademarks of Saison Information Systems Co., Ltd

- The company names and product names mentioned in this document are trademarks or registered trademarks of their respective companies.

- Trademark symbols (TM, ®) might not be appended to the system names, product names, etc., mentioned in this document.