Seven Bank, Ltd.

Seven Bank aims for company-wide adoption of AI and data utilization.

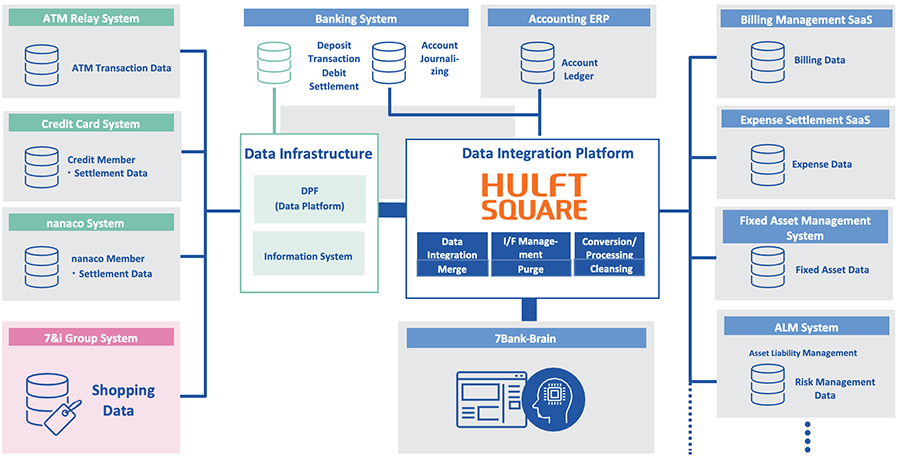

HULFT Square contributes to the implementation of data integration platform and generative AI utilization environment.

Seven Bank’s purpose is to continue to shape the future of everyday life by seeing customers’ wishes and going beyond and it has earned the trust of many customers through consistent innovation and convenience. As a financial institution of a major retail group in Japan, the company has been promoting company-wide use and establishment of AI and data since 2018, based on bank account data and the group’s detailed shopping data. In recent years, it has begun generating tangible business results through the use of generative AI, supported by a unified data foundation. The company selected HULFT Square as a data integration platform for collecting all kinds of data within the company and as a means for verifying the generative AI project. Key factors in the decision included ease of use, reliability, and comprehensive support uniquely offered by a Japan-based iPaaS* like HULFT Square as well as the ability to support diverse business systems and build a secure environment for using generative AI.

The Challenge

- To develop a flexible infrastructure that allows seamless in-house integration of all types, including corporate systems, various service systems and business systems

- To verify whether the new platform can be used as a means of utilizing generative AI

Results Summary

Supports all system environments, from on-premise to SaaS, and easily enables data integration

Easy-to-use interface suited to Japanese business practice, facilitating in-house development

Contributes to verification of data analysis using natural language by linking with Microsoft Azure OpenAI Service

Project Background

Seven Bank, working on AI data utilization and internal establishment of generative AI, aims to build a platform for easy data integration.

Seven Bank was established in 2001 in response to their customers’ wishes that it would be convenient to have ATMs at convenience stores. Seven Bank currently operates approximately 28,000 ATMs in Japan and has 670 business partners. Currently, approximately 28,000 ATMs are in operation in Japan, and the number of business partners is 670. The company is also aggressively expanding its business globally including the U.S., Indonesia, and the Philippines, it has expanded into Malaysia in 2024.

Seven Bank is unique in that it is the financial institution of one of the leading retail groups in Japan. It holds not only bank account information but also a vast amount of shopping data generated by its stores as assets of the group. While credit cards can also be used to acquire payment data, Seven Bank has detailed receipt information on when, where, and what kind of purchases were made. Naturally, the level of granularity of the insights obtained is different.

Mr. Yoshiyuki Nakamura,

Mr. Yoshiyuki Nakamura, General Manager,

AI Data Strategy Division,

Seven Bank, Ltd.

To leverage this data asset for business, the company has been working to promote and establish company-wide use of AI and data since 2018. At the core of this effort is the Seven Bank AI Data Strategy Division. Mr. Yoshiyuki Nakamura, General Manager of the AI Data Strategy Division, explains, "Even if a person participates in a training program and acquires data utilization knowledge, it is meaningless unless it is applied to actual business. Our main goal is to make the use of data “take root” in the workplace."

For this reason, in addition to training, the company has promoted the establishment of data utilization in the workplace through practical boot camps. At the same time, the company has also focused on AI and worked hard to establish it in the field.

AI is a new technology that follows existing IT and is a revolutionary technology that can extract insights that people have not yet noticed. By quickly applying such AI and data to actual management and business operations, significant business benefits can be gained.

Seven bank is noticing results already. One example is the provision of card loans based on shopping history. Regular card loans are granted based on financial data such as monthly income and borrowing status from other companies. Therefore, it has been difficult for gig workers who earn their income from one-time part-time job applications to obtain loans, even if they have sufficient repayment capacity and can repay the loans in a planned manner. In response to this, Seven Bank has improved its screening accuracy by combining financial data with shopping data and is now able to find customers to whom it is safe to offer loans among those who could not be offered loans with the conventional screening method.

Recently, the company has been focusing on the use of generative AI. “There is no doubt that generative AI will become increasingly pervasive in our daily lives in the future. Therefore, we will be working on generative AI in earnest in fiscal year 2025 to utilize it in our business," says Mr. Nakamura.

An essential part of this process is the establishment of an internal data infrastructure. In addition to the bank's accounting systems, the company has a vast number of systems that are essential to its business, including credit, e-money, and CRM for the entire group. The company had built a data infrastructure to utilize data from these systems, but considering future development, it needed a system that would allow for easier, in-house data integration from a variety of data sources.

The Solution

HULFT Square was introduced in conjunction with the renewal of the accounting system and was also adopted for a generative AI verification project.

Seven Bank decided to adopt HULFT Square, a cloud-based data integration platform (iPaaS), as a mechanism to easily realize data integration. However, the company did not originally decide to adopt HULFT Square for its data infrastructure, but rather, "It was the renewal of the accounting system that triggered the decision," Mr. Nakamura explains.

In addition to the core on-premise banking account system, Seven Bank's accounting system has a complex configuration, with invoice management, expense accounting, fixed asset management, and ALM (Asset Liability Management) systems built in a SaaS environment. The process of linking the fixed asset system to the bank's accounting system was complicated by manual checks, and the accounting work itself had become dependent on individual staff.

To improve this situation, the company decided to update the accounting system based on the Fit to Standard policy. At the same time, HULFT Square was adopted to optimize data integration with peripheral systems. HULFT Square is equipped with the technology of HULFT, a file integration tool that has been used for over 30 years, and DataSpider Servista, a data integration tool, and achieves flexible integration across all system environments, including on-premise, SaaS, cloud, and web.

The company decided to use HULFT Square for integration with the data infrastructure as well. Mr. Nakamura explains, “The data sources of the data infrastructure include a wide variety of heavy-duty assets such as bank accounting systems, ATM relay systems, smartphone applications, group CRM, and credit card systems. Some of these systems are mission-critical and would affect services to customers if they were to stop working, so until now we have built the infrastructure with one-to-one data integration to ensure safety. However, going forward, we will need a mechanism that makes it easier to collect data from peripheral systems. That’s why we decided to use HULFT Square, which has overwhelming strength in the data integration field, not only for data integration with the accounting system, but also as a bridge to our data infrastructure.”

The deciding factor in the adoption of HULFT Square was its overwhelming ease of use and a sense of security as an iPaaS developed in Japan, as well as its comprehensive support system that comes with being developed in Japan. In particular, the ease of understanding of the GUI and customer support were major advantages.

"We had previously considered introducing an iPaaS product when building our data infrastructure, and we considered other products. However, we decided against it due to reliability, ease of use, and support of HULFT Square, created in Japan. It was the best choice for us, as we plan to develop data integration in-house in the future," says Mr. Nakamura. Thus, in the spring of 2024, the project to renew the accounting system and build a data integration infrastructure began.

The use of HULFT Square was not limited to this. HULFT Square was also adopted in the company's project to introduce and verify generative AI. This is part of the company's efforts toward the aforementioned "full-scale deployment of generative AI from fiscal year 2025.” The company has developed "7Bank-Brain," an interface for in-house use of generative AI, and is working to establish generative AI in the workplace, and is currently implementing data analysis using natural language.

To achieve data analysis using natural language, SQL must first be generated by a generative AI from the input natural language prompt. Then, multiple processes will be executed, such as accessing the data source, retrieving the desired data by SQL, and executing the analysis. A mechanism for linking data with the original data source is also required. In addition, data security and confidentiality must be taken into account, making the use of generative AI in the business environment a hurdle to overcome.

HULFT Square solved this problem. It has a job-setting function that allows multiple processes to be executed. Taking advantage of this function, the company's verification project decided to safely execute the use of generative AI in an Azure environment. Part of the company’s data source, which is in a closed environment, was manually copied and uploaded to the Azure environment, linking Azure and HULFT Square. When users enter natural language prompt in 7Bank-Brain, HULFT Square calls the generative AI in the Azure environment to generate SQL, graphs, and insights.

"Due to the complexity and security of the implementation, we had a hard time getting started on verifying data analysis with natural language. We considered multiple tools but were hesitant because they all required uploading the data once to the vendor. When Saison Technology heard about this and made a proposal, we found that the analytical environment we were looking for could be implemented with HULFT Square, so we decided to go ahead with development. We are so glad that we introduced HULFT Square," says Mr. Nakamura.

Business Impact

Seven Bank expects many gains when HULFT Square can accelerate decision-making through data analysis using natural language.

The company is currently in the process of revamping its accounting system and building a data integration infrastructure using HULFT Square, and is about to launch a project to introduce and verify generative AI. Mr. Nakamura says, "The implementation of data linkage is HULFT Square’s area of expertise, so we feel it easy to work with. Saison Technology has professionals with deep expertise in data integration and utilization, so we consult with them as needed.” Above all, he expresses his expectations, "Once the data integration can be achieved, the processes that used to be done manually will be automated, making it more efficient and eliminating errors."

One of the objectives is to accelerate data integration through in-house development. Currently, the development partner is taking the lead in completing the project, but after the accounting system renewal and the data integration platform are up and running, the company plans to accumulate knowledge of data integration with support from Saison Technology.

Even more promising benefit is a data-analysis approach using natural language. If this can be realized, "I believe that the decision-making process at management meetings will change dramatically," says Mr. Nakamura.

“Even if we develop a new service, we cannot take any action without analyzing trends in our customers’ situations and needs. Currently, data analysis requires the use of SQL and BI, so the number of people who can analyze data is limited. To solve this problem, we are training people like data analysis ambassadors in each department, and if they can analyze data in natural language, there will be no problem. Just by asking during a meeting, ‘What are the trends in debit card usage of customers with a deposit balance above a certain amount?’ or ‘What are the characteristics of this customer group?’ we will get an answer, which should dramatically speed up the decision-making process. We expect this to lead to major innovation."

Future Outlook

Easy data integration further expands possibilities, and further utilization of HULFT Square is also possible.

After the completion of the ongoing project, Seven Bank has high expectations for Saison Technology's support and follow-up to promote full-scale in-house data integration. Once the data integration platform is in place and easy data integration is realized, the possibilities will only increase. Since HULFT Square can be used not only for flexible and easy data integration, but also for data processing before and after data analysis, the company is also exploring the use of HULFT Square as software.

The use of ATM data is one such example. Currently, bank account data is being examined, but if ATM data can also be analyzed, the landscape will look different.

“For example, ATM services used in urban centers and rural areas differ. Usage also changes when the number of partner banks increases or when fees are changed. There are a billion transactions alone, so just analyzing them in a normal way is difficult, but if we can ask these questions in natural language and understand them, our business will make great progress. In the future, we would like to include globally deployed ATMs in our analysis," says Mr. Nakamura about future prospects.

* iPaaS (Integration Platform as a Service): A cloud service that provides a platform for integrating and linking systems and data.

Company Profile: Seven Bank, Ltd.

- Head office

Marunouchi Center Building, 1-6-1 Marunouchi, Chiyoda-ku, Tokyo, Japan - Established

April 10, 2001 - Capital

30,724 million yen - Number of employees

666 - Business Activities

General financial business including ATM platform business, retail business, corporate business, and overseas business